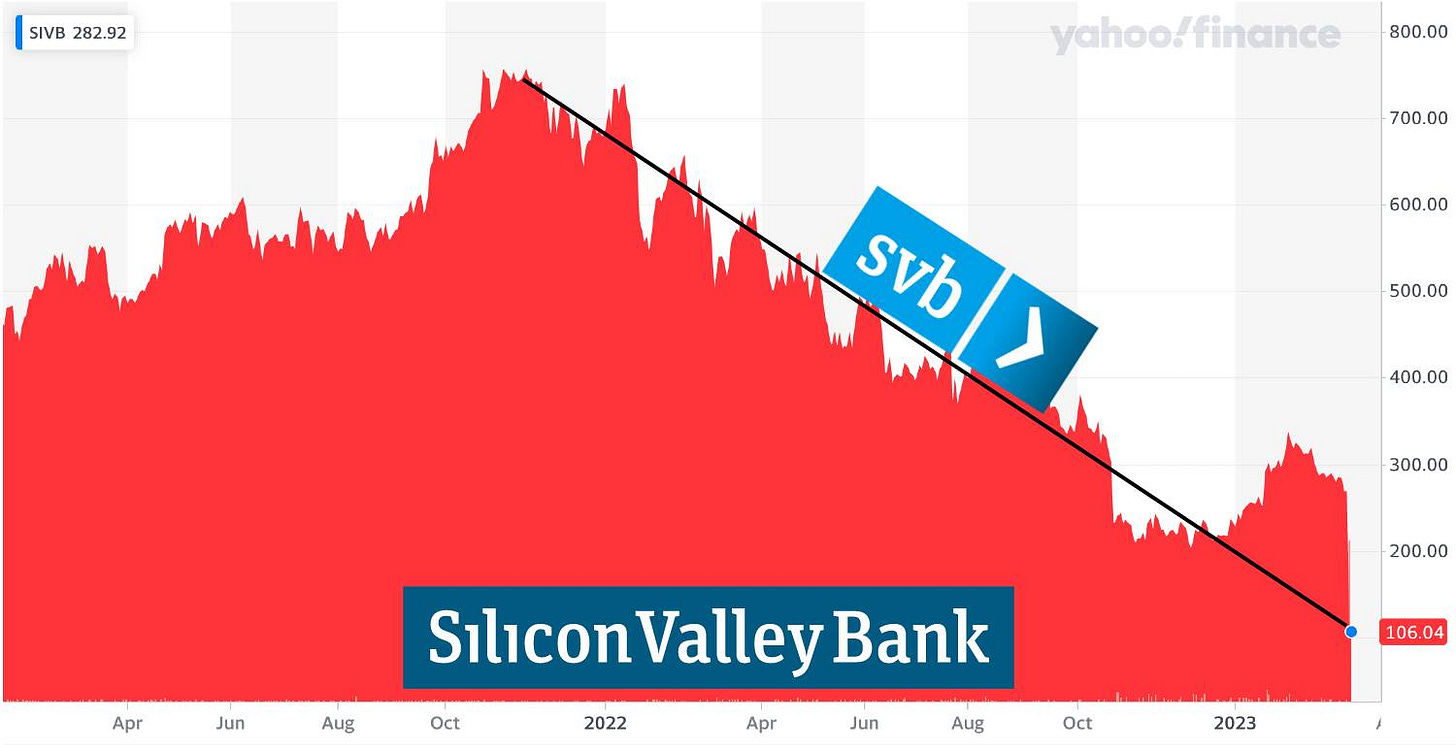

The Silicon Valley Bank run and why more is coming

The run on SIVB will cause ripples — maybe tidal waves — through Wall Street. But it wasn't the first and won't be the last. Our banking system guarantees it.

Bank runs have been a part of America’s cultural consciousness since at least the Great Depression. Although that was the largest series of bank runs in history and perhaps the most memorable, it was certainly not the first time that banks failed. Bank failures go back to at least the 17th century and continue to this day. Silicon Valley Bank is simply the most recent.

This article will not get into the weeds about the history of banking and Keynesian vs. Austrian economic theory. Instead, I only want to help readers understand the financial system we live in today — the one that allows us to buy cars, groceries, and Substack subscriptions like this one with the click of a button. Until the average person on Main Street understands how the system works and what its flaws are, we won’t be prepared to discuss solutions.

Bank runs are guaranteed in our flawed system

A bank run is what happens when too many people withdraw their money from the bank at once. This creates a shortfall because t…